Sophie Capital Review: Avoid Tha-SC.Com at Any Cost

The company name behind this is Sophie Capital Financial Trading Ltd. It was established and is believed to have been incorporated in the United States. On their website, Tha-SC.Com, they claim to be a licensed firm that operates as a forex broker in the US.

However, it’s known that only a small number of big companies are licensed to operate as brokers in the United States. Sophie Capital is not among those companies. So, we should dive deeper into this Sophie Capital review to find out more.

| Broker Status: | Unregulated |

| Regulated by: | N/A |

| Operating Status: | Active scam |

| Scammers Websites: | http://tha-sc.com/ |

| Blacklisted as a Scam by: | N/A |

| Broker Owner: | Sophie Capital Financial Trading Pty Ltd |

| Headquarters Country: | United States / Australia |

| Foundation Year: | 2022 |

| Online Trading Platforms: | MetaQuotes demo |

| Mobile Trading: | Yes |

| Minimum Deposit: | n/a – $500 for Professional account |

| Deposit Bonus: | Yes |

| Crypto Asset Trading: | No |

| CFD Trading Option: | Yes |

| Available Trading Instruments: | Forex, Commodities, Indices |

| Maximum Leverage: | N/A |

| Islamic Account: | No |

| Free Demo Account: | Yes |

| Accepts US clients: | Yes |

| Warning: | n/a |

Regulation and Fund Security of Sophie Capital

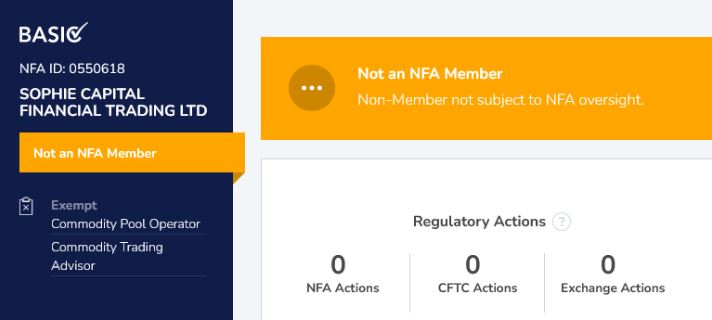

The NFA (National Futures Association) registry reveals that Sophie Capital is not a member. So, it’s clear that it is not under the oversight of the NFA. The company is registered as a commodity pool operator and trading advisor. This means it cannot offer financial services in the US. This type of registration gives the illusion of credibility. Sophie Capital also fails to provide access to the necessary legal documentation. The terms and conditions page does not include the name of the legal entity or specify a jurisdiction.

Investors should only do business with licensed intermediaries to avoid being scammed by unregistered entities. Consider choosing a company regulated by institutions such as the CFTC in the US, ASIC in Australia, FCA in the UK, or CySEC in the EU.

These regulators provide protections for clients such as negative balance protection and the segregation of client funds. In the EU and UK, brokers must also participate in schemes that compensate clients in the event of broker insolvency.

This compensation is up to 20,000 EUR in the EU and 85,000 GBP in the UK. Furthermore, regulators enforce strict net capital requirements, such as a minimum of 730,000 EUR in the UK and Cyprus, 1,000,000 AUD in Australia, and 20 million USD in the US, to minimize the risk of broker bankruptcy.

Trading Platforms Available

Sophie Capital apparently offers MT5, the best and most commonly used trading platform. However, the download link from their website is just a demo version from the developer, MetaQuotes. Sophie Capital does not provide login credentials. This means they don’t have functioning trading software and cannot deliver what they advertise.

It’s better to use a regulated broker that offers MT5 or MT4, ensuring advanced features and protection against scams. These platforms are widely preferred for their automated trading capabilities and more.

Account Types Offered at Sophie Capital

Sophie Capital apparently allows investors to trade a range of financial assets. This includes Forex, Metals, Commodities, Indices, and CFDs. They offer two account options:

- Standard

- Professional

The Standard account is for new traders or those who trade in smaller volumes. The Professional account is for experienced traders, with a minimum deposit amount of $500, and the ability to trade up to 1000 lots.

How Does The Con Actually Work?

In this day and age, many people remain unaware of the risks involved in trading. Scammers are taking advantage by posing as brokers and promising easy money. They may start by asking for a small investment.

Yet, they will eventually convince victims to give more money. In reality, the money is never invested and goes straight to scammers, who operate under fake and unregulated offshore companies and use untraceable payment methods.

Withdrawing profits or deposits may become impossible due to confusing terms and conditions, high volume requirements, and steep fees.

Note: We encourage you to share your negative experiences with us, whether it’s with this or any other fake broker. Your input can help protect others from falling victim to similar scams.

Deposit and Withdrawal Methods

It is unclear what payment methods Sophie Capital offers. Scammers often direct clients to payment methods that are non-refundable or hardly traceable, such as crypto assets. Legit brokers typically accept digital currencies alongside other transparent payment options, like credit/debit cards, bank transfers, or e-wallets like Skrill, PayPal, Neteller, or Advcash.

Without proper legal documentation from this firm, it is uncertain what schemes they may have set up. Fake brokers often make withdrawing funds difficult by implementing high fees and high trade volume requirements.

Top Forex Brokers

It’s advisable to take a look at some of the leading forex brokers that we recommend!

| Broker | Country, | Rating | Min. Deposit | Website |

| FXTM Broker | Cyprus, UK, Mauritius | 4.5 | $10 | Forextime.Com |

| OctaFX Broker | Cyprus, SVG | 4.4 | $100 | OctaFX.Com |

| FP Markets Broker | Australia, Cyprus | 4.7 | $100 | FpMarkets.Com |

| XM Broker | Cyprus, Belize, Australia | 4.7 | $5 | XM.Com |

| HFM HF Markets Broker | Cyprus, UK, South Africa, UAE, Kenya | 4.3 | $5 | HFM.Com |

| FBS Broker | Cyprus, Belize, Marshall Islands | 4.85 | $100 | FBS.Com |

Sophie Capital Summary

Sophie Capital is an unregulated broker and its trading software is only a demo version. Many users have complained about this broker. We recommend doing some research and verifying all the information about any firm before making any transactions.

We hope our Sophie Capital review has been helpful in every way possible. It is wise to be well-informed before deciding to invest.

FAQs About Sophie Capital Broker

Are Sophie Capital Regulated?

No, they are just another unregulated investment scam. They are no good for your investments.

Is Sophie Capital Legitimate Broker?

No, they are not legitimate, although they claim to be. Be aware of the many bogus tricks that they have.

Is Sophie Capital a Market Maker?

No, they are not. Sophie Capital is just an unregulated broker you better avoid. This is a fact!