FBS Review – Truth About FBS.Com Broker

Everyone recognizes a good broker when they see one. FBS has been in the brokerage business for over a decade already and its name is popular with traders across the globe. The company was established in 2009 and has quickly obtained several prestigious licenses.

The premium service and authenticity of the brokerage enterprise are confirmed by financial authorities in Cyprus, Australia, South Africa, and Belize.

With the priority of offering the most competitive trading conditions and focusing on the customers’ needs, FBS makes for a helpful and dedicated broker-dealer present in almost every continent.

FBS has won many awards, and every year they continue to do so. Although there are online financial services providers with longer histories on the market, FBS has collected more awards than many of them. Our FBS review examines what the broker has to offer and how you can best use their services.

| Headquarters | Cyprus and Belize |

| Regulation | CySEC, ASIC, IFSC and FSCA |

| Platforms | MT4, MT5, FBS trader |

| Instruments | Forex, stocks, indices CFDs, share CFDs, CFDs on valuable metals, CFDs on energy, Crypto |

| Demo Account | Available |

| Minimum Deposit | $10 |

| EUR/USD Spread | From 0.9 pips |

| Base Currencies | EUR, USD, GBP, AUD, CHF, CAD, NZD |

| Education | Articles, Video guides, Webinars |

| Customer Support | 24/7 |

FBS License and Regulation

Regulated by multiple jurisdictional financial authorities is a confirmation that FBS is indeed a reliable company. Since they offer services to clients all over the world, adhering to the jurisdictional licensing rules is an absolute priority.

Two main offices in Cyprus and Belize have been registered with CySEC and IFSC. CySEC has some of the world’s harshest standards, considering they’re an EEA broker.

Some of the conditions that the firms with ambition for broker business must meet are the starting investment of 730.000 EUR. This is an enormous amount of capital that not every company can deposit. Only highly stable and reliable enterprises with competent teams and long-lasting business plans can enter the brokerage business.

Top-tier Financial Authority

Furthermore, the companies must ensure the safety of customers’ funds by keeping them in segregated bank accounts and separated from the firm’s capital. Leverage limitations are in order so CySEC doesn’t allow brokers to offer leverage higher than 1:30.

Along with that, negative balance protection helps prevent great losses from occurring without expectation. Compensational funds are special refund programs that clients have access to in case the firm fails to pay off what they owe the clients.

All in all, CySEC is a strict EU regulator and a top-tier financial authority in the EEA zone. ASIC is another financial watchdog that oversees brokerage activity in the AU. These two regulatory entities have somewhat similar licensing conditions and they stand for some of the most demanding financial bodies in the world.

In contrast to that, IFSC and FSCA have established slightly different regulatory criteria. Belize has significantly improved and now demands brokers to meet much harsher conditions if they wish to become a fully regulated business. Still, international clients should be somewhat careful, as regulatory rules cannot protect them the same way as EU and AU clients are protected.

Trading Instruments Available at FBS

FBS is definitely an advanced, premium brokerage. Although, compared to other brokers of this level, FBS has a somewhat more limited offer of tradable assets.

The leverage on different financial instruments and depending on the jurisdictional regulatory rules can go up to 1:3000. According to the trading expenses, FBS falls under the category of low costs and spreads starts from 0.9 pips on EUR/USD.

Financial instruments cover several groups as shown below:

- Currency pairs (EUR/USD, AUD/USD, GBP/USD, USD/CAD, USD/CHF, CAD/USD, EUR/JPY)

- CFDs on digital currencies (Bitcoin, Ethereum, Dash, Litecoin, Ripple, EOS, Emercoin, Stellar, Polkadot)

- CFDs on precious metals and energies (Gold, Silver, Natural Gas, Crude Oil)

- CFDs on indices (US100, US30, AU200, EU50, DE30, JP225)

Account Types Offered at FBS

Tailored to every trader’s needs, account types at FBS are varying but certainly comprehensive and rich in features. Clients are able to easily open an account they wish and then go from Demo to Live.

The offer of the trading accounts at FBS is the following:

- Micro account – $5

- Cent account – $1

- Standard account – $100

- Zero spread account – $500

- ECN account – $1.000

- Crypto account – $1

Every account type has its benefits and all are in accordance with the regulatory rules of the area where the client resides. All accounts bring the advantage of quick opening, relatively low deposit requirements, high execution speed, the option to easily switch between demo and live trading accounts, and a range of instruments for trading.

Trading Platforms Used at FBS

Staying above the competition in the Forex market is impossible without owning the latest technological discoveries for online trading. FBS has to offer clients the standard and most widely used MetaTrader 4 and MetaTrader 5, as many other top brokers do.

These software solutions are known to be ruling the online trading market for years now and trading financial instruments successfully is almost unimaginable without MT4 and MT5.

Known as rich in progressive features, multilingual interface, and support, these software giants in the online trading world are a must for every popular broker. Countless positive reviews and the highest ratings by users can confirm that MetaQuotes has released the two best-performing online trading tools in the industry.

FBS has achieved their own excellence by developing a comprehensive and easily navigated software – FBS Trader. With its speed, built-in indicators, timeframes and customization tools, FBS trading platform can keep up even with the most advanced MT4 and MT5. Although more recommended to professional investors and long-term traders, FBS Trader is a useful tool for anyone aiming to achieve their final investment goals.

FBS Deposits and Withdrawals

Customers can sometimes feel insecure when it comes to investing, especially concerning the safety of their deposits and certainty of withdrawals. With FBS, traders need not worry.

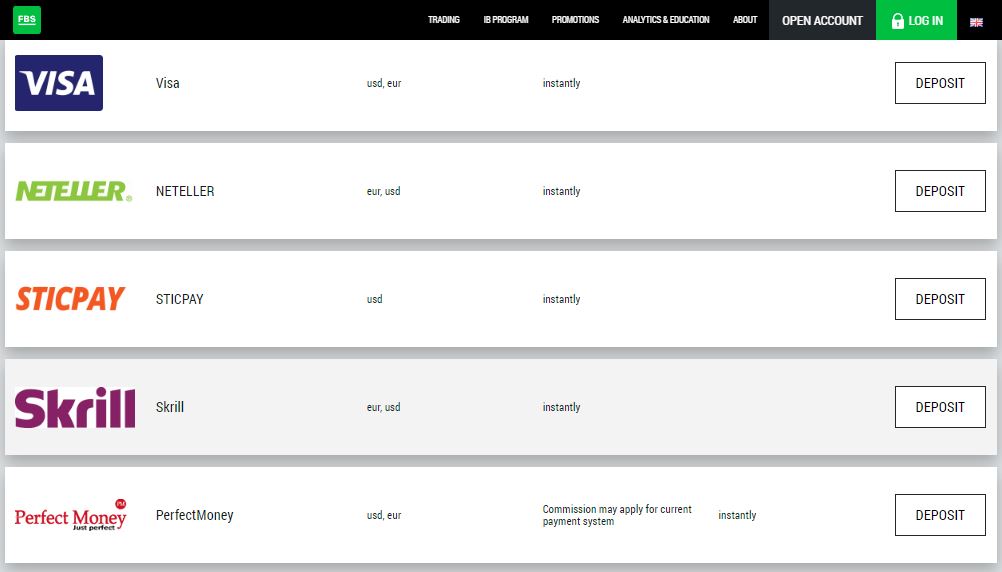

All channels of transactions are utmost safe and secure and most of all – fast. That’s how deposits take from 15 minutes to 48 hours to appear on your live trading account, while withdrawals do not take more than 2 business days to process.

Standard practice is to offer the most secure methods of funding live trading accounts, so FBS does so. Clients can use bank wire transfers, credit cards, and E-wallets to perform money transfers.

Except for wire transfers, other funding methods are instant and fee-free. Incurring fees happen with the third party involvement and in the case of currency conversion. Otherwise, FBS charges very low fees for these transactions that generally don’t affect traders’ investment decisions.

However, it’s always useful to pre-calculate the expenses before you determine what money transfer method would be the best to use.

FBS Offers Bonuses and Promotions

Although zones, where bonuses are prohibited, cannot enjoy the benefits of being a FBS client, international clients can access some of the very attractive promotions:

- Birthday Party – FBS celebrates their anniversary and every year 100 prizes are given in the form of laptops, cars, phones and other goods.

- FBS Traders Parties – annual meet-ups and events in different parts of the world for traders to gather and enjoy exchanging ideas and experiences.

- 100% deposit bonus – an added amount that traders can apply for after funding their trading account.

- Level Up Bonus – total bonus cash of $140 rewarded to traders who have traded for at least 20 days at FBS.

- Loyalty program – long-time traders at FBS can apply for loyalty programs that bring benefits, prizes and commissions.

Education Available at FBS

Every dedicated team of experts running a brokerage house is well aware of the importance of knowledge and skill their clients possess. They’re also acquainted with how much their own success depends on the success of their traders.

FBS team of leaders has recognized the necessity of helping their users advance and create more profitable trading strategies that would give them an edge on every market.

For that very reason, FBS has designed a collection of educational materials according to every trader’s level, be it beginner, elementary, intermediate or advanced.

If you are still a beginner struggling to get a grip on the basics of trading tactics, instruments and platform you may use step-by-step guides on how to start. More advanced users can access video tutorials where experts explain how concrete trading elements work and how to use them to your advantage. For professional traders, live lessons and webinars are held almost on a daily basis. Everyone can choose their tempo of learning.

Customer Service

Contacting customer support at FBS is made easier with multiple ways of communication. FBS has several phone numbers and email addresses for you to use 24/7 in order to contact the staff.

If you would like to explain your issue to the FBS agent in a call, you can make an appointment and your manager or FBS support agent will give you a callback. Another way to directly message FBS help center is by using the live chat feature on the site. This is perhaps the fastest way of contacting customer service as it provides instant messaging.

All in all, customer support service at FBS is very diligent and responsive. You are free to contact them any time of the day for advice on how to solve any persisting issue. Whether your problem is related to the software installation and set up, account opening or funding methods, you can get helpful help solving the issue in a very short notice.

FBS Overall Summary

As discussed throughout this FBS review, this brokerage conglomerate is a multi-regulated company in several countries. Serving thousands of customers worldwide, FBS has established a reputation of a strong, stable and client-oriented business.

Numerous online reviews by clients content with the service are a good testimony to the greatness of FBS customer service, good pricing, affordable fees and security of funds. 4 regulations from acclaimed licensing services are another proof of the firm being reliable and safe for investing.

Openness, friendliness of agents and dedication of FBS to their clientele is present in every way you communicate with your broker. Not only can you get help in resolving any issue possible, but you can always refer to the broker’s extensive knowledge base if you want to keep improving your trading skills.

FAQs About FBS Broker

Are the Funds in my Trading Account Safe at FBS?

FBS is a safe brokerage site to invest with. All the regulations they respect prevent them from any misuse of funds deposited by clients.

How Can I Deposit Funds at FBS?

Bank wire transfers, credit and debit cards, as well as E-wallets are methods for funding your live trading account at FBS.

What Documents are Required to Create a Live Account at FBS?

Any personal document that enables verification is enough to apply for a live account opening at FBS.

What Account Types Do FBS Offer?

Standard Spread Account, Micro Account, Zero Spread, Cent Account, Islamic, ECN and Crypto account, along with a Demo account are types of accounts available at FBS.

Does FBS Offer Demo Account?

Yes, trading with virtual funds for a limited time period is available on the FBS site.