FXCC Review – Is FXCC.Com a Reliable Broker?

FXCC is a CySEC-regulated broker with a reliable trading platform. All of its clients have the same level of access. Moreover, all deals are conducted quickly with no holds or re-quotes. This broker delivers a lot to its customers. For instance, trading conditions, instructions, and the MetaTrader 4 platform.

FXCC presents practical currency spreads and clear pricing. What’s more, the same goes for the ability to use any trading strategy. The company has a valid license from Cyprus Securities and Exchange Commission.

In this FXCC review, we will see various elements of the brokerage house. Is FXCC good for beginner traders? What about the minimum deposit? Keep reading to find out more details about this multi-asset broker!

FXCC Pros and Cons

| Country of Regulation | Cyprus and St. Vincent & the Grenadines |

| Trading Fees Class | Low |

| Inactivity Fee Charged | Yes |

| Withdrawal Fee Amount | No |

| Minimum Deposit | No |

| Time to Open an Account | 1-hour |

| Deposit with Bank Card | Yes |

| Depositing with Electronic Wallet | Yes |

| Number of Base Currencies Supported | 30 |

| Demo Account | Yes |

| Products Offered | Forex, Commodities, Crypto, Indices |

Let’s first focus on the advantages of the FXCC broker. The first one is that trading with FXCC comes with no commissions. Traders from Europe can effortlessly trade commission-free. Then there are no minimum deposit conditions, which is terrific for newbie traders. This platform supports traders from all over the globe, which is quite convenient.

What’s more, there is a first deposit bonus as well as other interesting deposit bonuses. Ultimately, you will find amazing trading conditions and zero deposit fees.

There are just a few drawbacks and you should acknowledge them. For example, traders are not able to use the MetaTrader 5. Also, similarly to other legitimate brokers, there is only one account type.

FXCC Reliability – Regulation and Security

FXCC broker is a company that is fully regulated by the Cyprus Securities and Exchange Commission, CySEC. It has an innovative, regulatory habitat for international clients. Forex trading brokers must satisfy strict financial criteria that include capital sufficiency and keeping funds in segregated accounts.

Major currency pairs, commission fees, trades, interest rates, complex instruments, and log-in details are strictly monitored and duly licensed.

Account Types Available

| Broker | FXCC | FXTM | OctaFX | FPMarkets | XM Broker | HFM | FBS Broker |

| Minimum Deposit | No | $10 | $100 | $100 | $5 | $5 | $100 |

FXCC offers three ECN accounts separated by the level of trading size, background, and special demands. Some of the accounts have extra benefits. Those can be zero swaps, commissions, mark-ups, or perhaps fully custom solutions for active traders or those who operate bigger sizes.

With an FXCC ECN account, you will access numerous currencies showcased with spreads from 0.01 pips and the possibility to trade 30 currencies with a span of free tools.

Tip: Always remember that even with legitimate brokers, your funds may be at risk. Trading carries a substantial risk of losing money. Also, be careful about easy earnings and similar tricks. Not all brokers are legitimate like FXCC.

Deposits and Withdrawals at FXCC

To abide by the anti-money laundering policies, you will withdraw funds up to the initial deposit amount. FXCC presents several deposit and withdrawal traits. There’s a zero deposit fee paid by the FXCC processor after the deposit.

- Card: You can withdraw your funds with Visa and Mastercard. Deposits often take one hour to finalize and up to 6 days to clear. FXCC broker does not charge an extra fee for withdrawal.

- Bank Wire Transfer: It can take 5-7 business days for wire transactions. Withdrawals take up to 7 working days to get to a trader’s account. However, the fee for every transaction is 30 USD – 45 USD.

- Union Pay: Deposits are completed within one hour. It takes up to 5 days to withdraw with a price of 45 USD.

- Neteller: Withdrawals happen in real-time, in less than an hour. Yet, the customers are charged 2.7% on the amount.

- Skrill: Just like Neteller, it takes one hour for the whole process. Moreover, the customers are charged 2.7% on their amounts.

- Crypto: Deposits are quick, and withdrawals are processed within a day. Yet, there are “mining fees” on deposits and withdrawals.

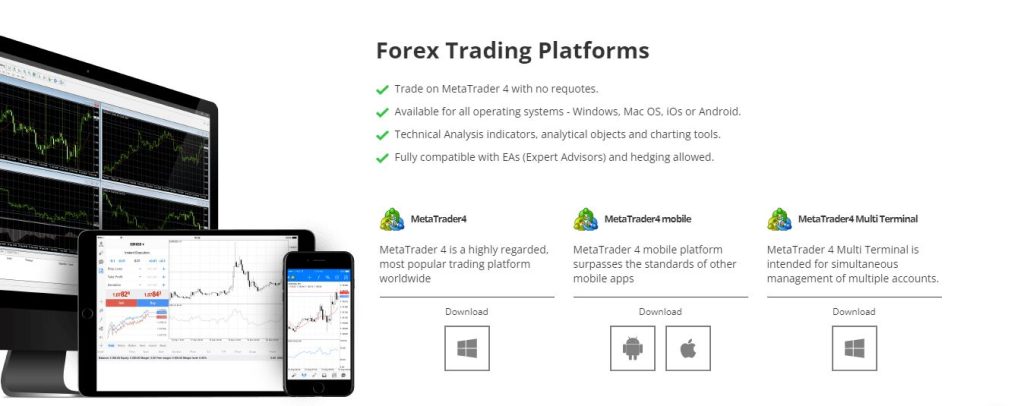

FXCC Trading Platform

Customers have access to the entire suite of the avant-garde MT4 trading platform. There is an option for automated trading. What’s more, this is one of the most adaptable trading platforms out there.

MT4 upgrades are available via third parties for an extra fee to boost the trading experience. One crucial benefit is that FXCC presents a more in-depth intro to MT4. Note that many brokers fail to do this.

FXCC Platforms have a rating of 7/10. It’s a good thing that they use the industry-standard MT4 platform. Yet, the lack of alternatives is a significant disadvantage.

Desktop Trading

FXCC platform has a practical desktop version and a mobile app. Notably, every FXCC customer can apply for free trading tools via the Traders Hub.

There is a vast scope of tools that help with the daily trading processes. You can also trade with a free VPS (Virtual Private Server) that carries speed and execution.

FXCC Trading Instruments

Research shows that the broker presents a wide range of trading instruments. It allows trading major and minor pairs and crypto with access to BTC, LTC, and ETH. It also permits the trading of precious metals and fuels. Yet, trading requirements and the availability of the assets rely on the jurisdiction.

Research and Education

Traders, whether newbies or skilled ones, can learn many things. They can learn via the supplied scope of educational resources and study in two separate forms. The daily technical research is available on the web page with updated details and a retest of the momentum.

The broker presents a spectrum of educational resources like guides and writings. However, this spectrum of tools seems to be limited.

Customer Service

As per the FXCC review and analysis, we can see that the platform delivers customer support 24 hours a day. You can reach them via telephone, email, or live chat. Click on the chat logo in the lower right corner of the web page, which is a live chat service. Also, people can access the FXCC FAQ section for easy queries and doubts.

- Contact FXCC at [email protected],

- You can contact them via call as well;

- The chat team can assist you with withdrawal issues, signup queries, and more.

Topics about trading style, investment advice, and mobile trading are covered via customer support. New traders may find it alarming to start trading in brokerage services. Customer service provides details about many things, by all means.

FXCC Overall Summary

So, what did we learn from this FXCC review? You can create a mixed trading portfolio and access superb trading conditions. Long ago, such practices were long-delayed. The traders barely face any technical issues. Moreover, the firm offers competitive leverage and calls attention to user reviews.

The forex broker provides an FXCC demo account to test trading requirements. The same goes for trading tools, instruments, financial markets, bots, market prices, and many trading assets. FXCC broker supports both desktop and mobile trading.

Accounts with FXCC deliver services of excellent trading conditions. Also, the services of FXCC present good news over a specific period. FXCC broker provides fast trading using the well-known MetaTrader 4 platform.

Risk warning, no hidden fees, and demo accounts. We are well aware that all of these are striking for trading forex.

FAQs About FXCC Broker

What Account Types Does FXCC Offer?

There are 3 ECN accounts separated by experience, level of trading size, and some demands.

What Are The Deposit Methods and Fees at FXCC?

You can deposit money by using credit cards, crypto assets, digital wallets, and bank transfers.

What Is The Minimum Deposit at FXCC?

FXCC broker does not demand any minimum deposit amount from you. Keep this in mind!